Benefits for Industry 4.0 in 2020: what tax measures and incentives are provided for companies that invest in innovation? Let’s find out in this article!

Benefits for industry 4.0 in Italy

Manufacturing companies are the engine of growth and economic development in our country, thanks to their ability to produce wealth and employment, their ability to fuel related industries and service activities and their contribution to financial, social and economic stability.

The Industry 4.0 Plan is therefore a great opportunity for all companies wishing to take the opportunities associated with the fourth industrial revolution; the objective of the Plan is to encourage investment in innovation, thus increasing competitiveness.

In the Industry 4.0 Plan of 2020, the super and hyper amortization have not simply been extended, but have been transformed into tax credit by the Budget Law, according to a plan aimed at encouraging especially small and medium-sized enterprises.

A tax credit is therefore recognized for investments in technologically advanced capital goods and intangible capital goods functional to the transformation processes 4.0. Among the technologically advanced capital goods, robots, collaborative robots and multi-robot systems are included. The “Nuova Sabatini” measure is also confirmed: it’s the benefit made available to support companies that require bank loans for investments in new capital goods, machinery, equipment, software and hardware.

Benefits in France

France, together with Italy, is the only “big” European country to present a real tax strategy for the development of Industry 4.0, with custom-made measures and articulated regulations.

In fact, in France there is a favourable taxation regime and a tax credit for the costs of technical research and high specialization. In addition, amortization of 140% is expected for the purchase of machinery functional to Industry 4.0, but only for smaller companies.

Benefits in the Netherlands

The Netherlands, where we talk about Smart industry, have provided a tax credit for companies that carry out research and development activities and for start-ups; on the other hand, there are no super amortization measures.

Benefits in Germany

Germany led the way with “Industries 4.0” in 2011, but at present there are no measures and incentives for Industry 4.0: Germany prefers direct, national or federal funding.

Horizon Europe, the new European program for research and innovation

Horizon Europe is the next European Program for research and innovation for the years 2021-2027 and will succeed Horizon 2020 (2014-2020). Horizon Europe, with a budget of around 100 billion euros, is the most ambitious European program ever in the field of research and innovation.

In Horizon Europe, artificial intelligence aims to overcome the phase of technological experimentation and land in a phase of regulatory and innovation experimentation.

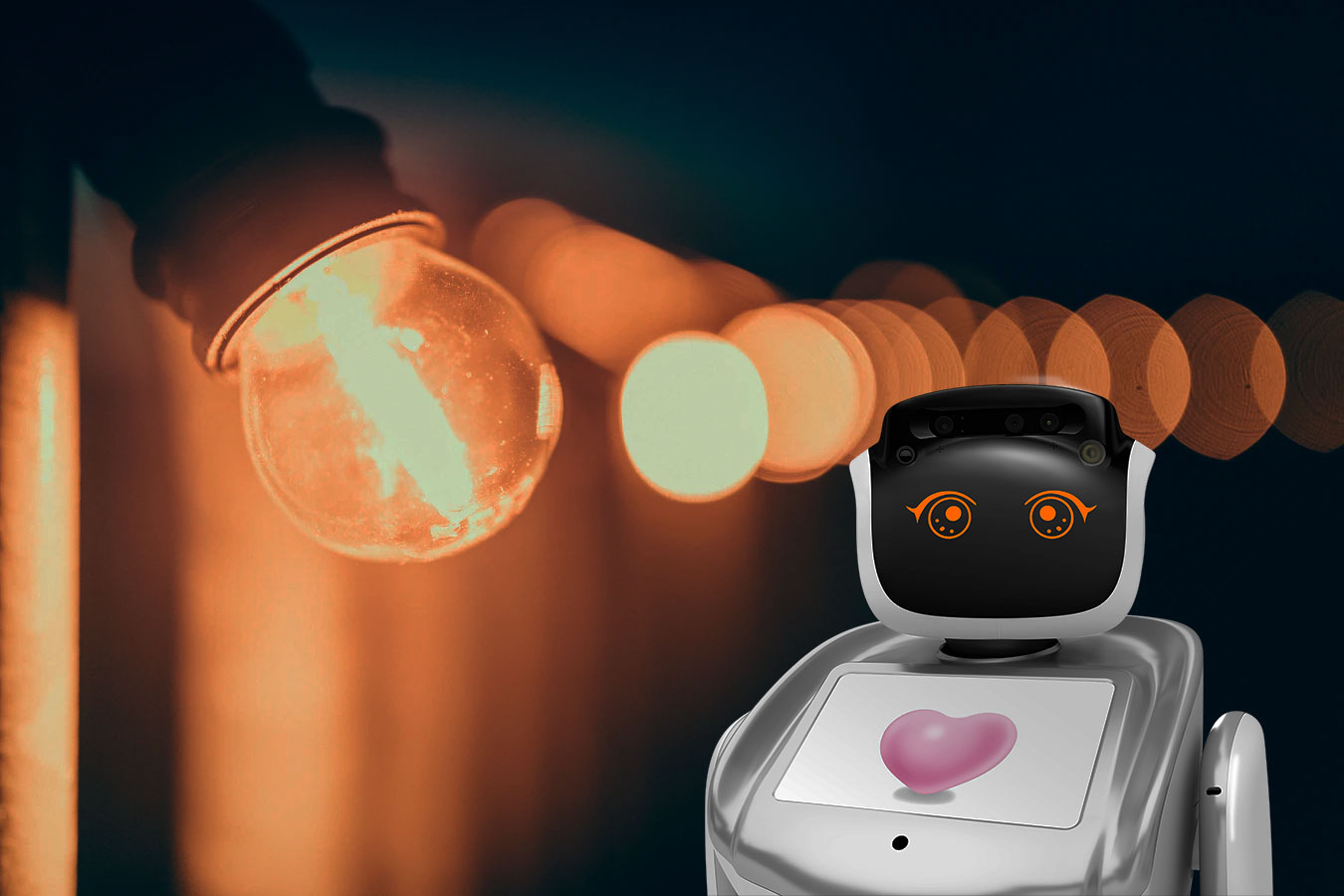

Omitech Robot, rising star in social robotics

We at Omitech Robot started our journey in robotics convinced that social robotics could be an effective tool for business.

We have developed Vivaldi, the artificial intelligence capable of controlling and adapting the behavior of robots with humans and with the surrounding environment. Vivaldi is a software that can be combined with different selected robot platforms, creating a solution that can be adapted to different contexts.

Take advantage of the benefits designed for robotics and contact us for a customized solution!